IntroductionChoosing between an MBA vs Masters in Accounting can be challenging, as both degrees offer unique opportunities for career growth….

Masters In Accounting

Explore the benefits of earning a Master’s in Accounting. Learn about flexible online programs, top career opportunities, and salary potential in this field.

Boost your career with a Master’s in Accounting. Learn essential skills, gain expertise, and open doors to top accounting and finance opportunities. Achieve your professional goals with confidence!

Introduction

If you’re fascinated by the language of numbers and the strategy behind financial decisions, a Master’s in Accounting can be your gateway to high-impact roles in today’s business world. This advanced degree builds on core accounting knowledge and dives deeper into financial reporting, auditing, taxation, and corporate analysis.

According to the U.S. Bureau of Labor Statistics, jobs in accounting and auditing are expected to grow 5% from 2024-2034, with over 72,800 openings each year driven by industry demand and workforce replacement needs.

Graduates often pursue careers as tax consultants, auditors, financial analysts, or prepare for professional credentials like the CPA, which many programs integrate into their curriculum.

What Is A Master’s in Accounting?

A master’s degree in accounting provides students with advanced skills and knowledge in accounting, finance, and related subjects. The Master of Accounting program covers taxation, audits, financial reporting, and management accounting. Both meet the criteria for certifications, such as CPA or CMA, and prepare students for leadership positions in the accounting industry.

Many universities offer on-campus and online Master’s in Accounting degrees, allowing working professionals the flexibility to tailor their education to the schedules. Specialized Master’s courses in Accounting, such as corporate finance, data analytics, and forensic accounting, are Graduates may specialize in areas such as taxation and forensic Accounting, preparing them for expanded career opportunities. With increased prospects in fields including corporate finance, consulting, and government, a Master’s degree in Accounting supports those looking to develop in their accounting careers.

🚨 Don’t Miss This Enrollment Cycle!

Top Masters in Accounting programs are filling fast. Secure your seat today.

Apply NowBest Master’s in Accounting Programs

Master’s in Accounting programs provide training in auditing, taxation, and financial management, preparing students for certifications like the CPA. These programs, available online and on campus, are ideal for advancing careers in accounting and finance with flexibility and quality education. Here is a list of the top colleges for pursuing a Master’s degree in Accounting:

| Rank | College/University Name | Location State | Type | Fee (In State) | Fee (Out-of-State) | Grad Rate (%) |

|---|---|---|---|---|---|---|

| 1 | Rice University | Texas | Online & On-Campus | $56,230 | – | 96% |

| 2 | University of Maryland | Maryland | Online & On-Campus | $16,891 | $36,822 | 89% |

| 3 | Ohio State University | Ohio | On-Campus | $12,890 | $41,729 | 88% |

| 4 | Gies College of Business | Illinois | Online & On-Campus | $15,986 | $31,114 | 85% |

| 5 | University of Minnesota | Minnesota | On-Campus | $19,980 | $31,212 | 85% |

| 6 | University of Connecticut | Connecticut | Online | $19,512 | $41,424 | 84% |

| 7 | University of Central Florida | Florida | On-Campus | $6,916 | $25,759 | 75% |

| 8 | George Mason University | Virginia | Online & On-Campus | $14,136 | $36,480 | 69% |

| 9 | Saint Mary’s University | Minnesota | Online | $12,474 | – | 68% |

| 10 | University of Washington | Washington | On-Campus | $17,688 | $31,707 | 68% |

| 11 | The University of Arizona | Arizona | Online & On-Campus | $14,738 | $33,992 | 66% |

| 12 | Asbury University | Kentucky | Online & On-Campus | $8,550 | – | 65% |

| 13 | Colorado State University | Colorado | Online & On-Campus | $12,150 | – | N/A |

| 14 | University of Southern California | California | On-Campus | $69,904 | – | 92% |

| 15 | Northeastern University | Massachusetts | Online | $28,786 | – | 90% |

| 16 | Tulane University | Louisiana | On-Campus | $67,004 | – | 89% |

| 17 | Gonzaga University | Washington | On-Campus | $21,402 | – | 87% |

| 18 | UMass Amherst | Massachusetts | On-Campus | $15,091 | $33,407 | 83% |

| 19 | Miami University | Ohio | On-Campus | $14,349 | $35,389 | 82% |

| 20 | Baylor University | Texas | On-Campus | $43,578 | – | 81% |

| 21 | James Madison University | Virginia | On-Campus | $12,216 | $29,736 | 81% |

| 22 | Bryant University | Rhode Island | On-Campus | $48,360 | – | 81% |

| 23 | Marist College | New York | On-Campus | $17,100 | – | 80% |

| 24 | Saint Louis University | Missouri | On-Campus | $24,660 | – | 80% |

| 25 | DeVry University | Arizona | Online | $9,312 | – | 80% |

| 26 | American University | District of Columbia | Online & On-Campus | $35,817 | – | 78% |

| 27 | University of Denver | Colorado | On-Campus | $40,885 | – | 78% |

| 28 | University of New Hampshire | New Hampshire | On-Campus | $14,520 | $28,500 | 76% |

| 29 | Iowa State University | Iowa | On-Campus | $11,492 | $29,102 | 75% |

| 30 | University of Oklahoma | Oklahoma | Online & On-Campus | $9,174 | $25,963 | 75% |

| 31 | Florida International University | Florida | Online & On-Campus | $2,215 | $21,600 | 74% |

| 32 | Sacred Heart University | Connecticut | Online & On-Campus | $34,394 | – | 74% |

| 33 | Mercer University | Georgia | Online & On-Campus | $14,671 | – | 73% |

| 34 | Bradley University | Illinois | On-Campus | $19,620 | – | 72% |

| 35 | Fairleigh Dickinson University | New Jersey | On-Campus | $24,588 | – | 72% |

| 36 | California State University Long Beach | California | On-Campus | $7,608 | $17,688 | 70% |

| 37 | Adelphi University | New York | On-Campus | $31,610 | – | 69% |

| 38 | The University of Kansas | Kansas | On-Campus | $10,855 | $26,030 | 69% |

| 39 | Suffolk University | Massachusetts | On-Campus | $37,944 | – | 60% |

Affordable Online Master’s in Accounting

Affordable online Master’s in Accounting programs offer a budget-friendly route without sacrificing academic rigor. Here is a list of programs that typically cost less than on-campus counterparts (due to lower overheads and no relocation expenses), and often offer flexible scheduling for working professionals.

| Rank | College/University Name | Location State | Type | Fee (In State) | Fee (Out-of-State) | Grad Rate (%) |

|---|---|---|---|---|---|---|

| 1 | Old Dominion University | Virginia | On-Campus | $11,328 | $31,692 | 44% |

| 2 | University of Colorado Denver | Colorado | Online & On-Campus | $8,352 | $26,208 | 47% |

| 3 | Marshall University | West Virginia | Online & On-Campus | $7,916 | $20,598 | 49% |

| 4 | Western Governors University | Utah | Online | $8,842 | – | 51% |

| 5 | Oklahoma Christian University | Oklahoma | Online | $10,620 | – | 55% |

| 6 | University of Michigan-Dearborn | Michigan | Online & On-Campus | $16,726 | $29,950 | 57% |

| 7 | University of Illinois | Illinois | On-Campus | $14,390 | $24,588 | 60% |

| 8 | Texas A&M University | Texas | Online & On-Campus | $5,558 | $12,902 | N/A |

| 9 | Fisher College | Massachusetts | On-Campus | $27,384 | – | 21% |

| 10 | San Francisco Film School | California | Online & On-Campus | N/A | N/A | 21% |

| 11 | Monroe College | New York | Online & On-Campus | N/A | N/A | 22% |

| 12 | Ottawa University | Kansas | Online | $11,682 | – | 29% |

| 13 | Texas A&M University San Antonio | Texas | On-Campus | $3,978 | $12,237 | 29% |

| 14 | New England College | New Hampshire | Online | $13,523 | – | 31% |

| 15 | Texas Wesleyan University | Texas | Online | $16,854 | – | 32% |

| 16 | Texas A&M University Corpus Christi | Texas | Online | $3,610 | $11,751 | 34% |

| 17 | Louisiana State University | Louisiana | On-Campus | N/A | N/A | 36% |

| 18 | South University | Tennessee | Online & On-Campus | $26,764 | – | 37% |

| 19 | Roosevelt University | Illinois | Online & On-Campus | $20,620 | – | 41% |

| 20 | Western Illinois University | Illinois | On-Campus | $9,133 | – | 45% |

| 21 | University of Michigan–Flint | Michigan | Online | $13,891 | $20,808 | 45% |

| 22 | University of Nebraska Omaha | Nebraska | On-Campus | $6,545 | $15,740 | 47% |

| 23 | Troy University | Alabama | Online & On-Campus | $8,550 | $17,100 | 47% |

| 24 | Mercy University | New York | On-Campus | $18,720 | – | 48% |

| 25 | Kennesaw State University | Georgia | Online | $5,454 | $20,142 | 48% |

| 26 | Cleveland State University | Ohio | Online & On-Campus | $11,128 | $20,938 | 49% |

| 27 | Wichita State University | Kansas | On-Campus | $6,099 | $14,986 | 51% |

| 28 | University of Tennessee at Chattanooga | Tennessee | Online | $9,120 | $17,184 | 53% |

| 29 | Youngstown State University | Ohio | On-Campus | $6,780 | $6,960 | 53% |

| 30 | Middle Tennessee State University | Tennessee | Online & On-Campus | $10,170 | $28,152 | 54% |

| 31 | Western Kentucky University | Kentucky | On-Campus | $12,140 | $18,340 | 54% |

| 32 | Tennessee Tech University | Tennessee | Online | $11,000 | $14,360 | 54% |

| 33 | LIU Brooklyn / Post | New York | On-Campus | $24,822 | – | 55% |

| 34 | Texas State University | Texas | On-Campus | $6,432 | $13,812 | 56% |

| 35 | University of Hartford | Connecticut | Online | $15,534 | – | 58% |

| 36 | University of New Haven | Connecticut | Online & On-Campus | $19,656 | – | 59% |

| 37 | Southern Utah University | Utah | Online & On-Campus | $7,801 | $24,497 | 59% |

| 38 | University of Illinois at Springfield | Illinois | Online & On-Campus | $8,838 | $16,415 | 61% |

| 39 | Pace University | New York | Online | $29,332 | – | 61% |

| 40 | University of Utah | Utah | Online & On-Campus | $7,610 | $26,869 | 64% |

| 41 | Florida Atlantic University | Florida | Online & On-Campus | $5,467 | $16,695 | 64% |

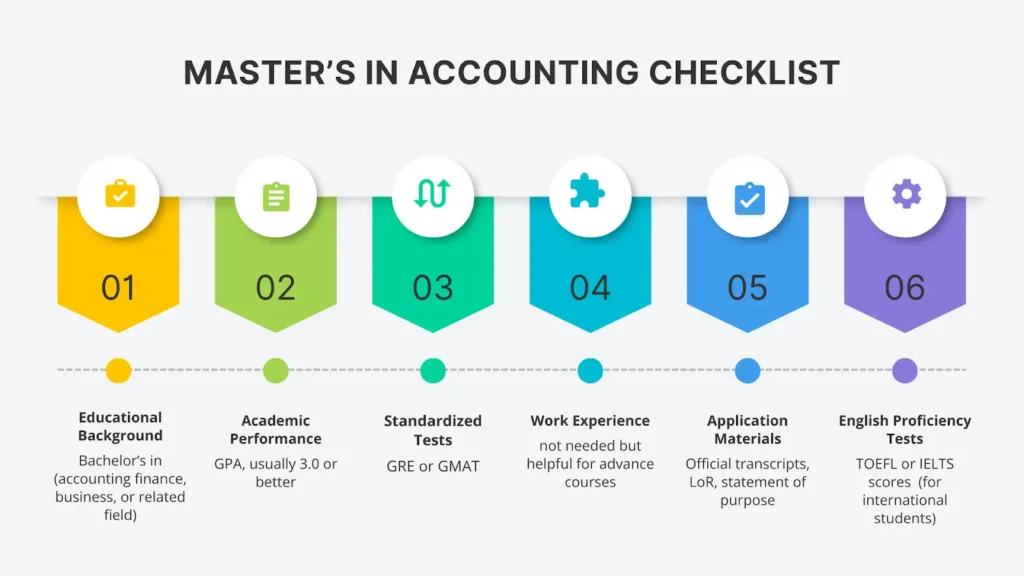

What is the Master’s in Accounting Requirements

While earning a Master’s degree in accounting would enable further accounting opportunities, fulfilling the program criteria is vital. Students usually need this:

2. Letters of recommendation from professors or employers

3. A well-crafted statement of purpose outlining your career goals and reasons for pursuing a Master’s in Accounting

4. A professional resume highlighting relevant skills and experience

Meeting these requirements demonstrates your readiness for the rigorous coursework in Master’s in Accounting programs, equipping you with the skills needed for a successful career in finance and accounting.

Cost of Master’s In Accounting

Along with tuition, fees, and other expenditures like books and lodging, pursuing a Master’s in Accounting comes with additional expenses, too. Here’s a breakdown to clarify the financial commitment:

1- Tuition and Fees

Traditional on-campus Master’s in Accounting programs will cost around $59,900 per year, depending on the university and location.

Master’s in Accounting online programs are often more affordable, between $25,000 and $70,000 according to US News, with added flexibility and savings on relocation or commuting costs.

2- Books and Supplies

Accounting courses often require specialized textbooks, costing around $500 to $1,500 per year.

3- Living Expenses

For on-campus programs, lodging, food, and transportation may cost $10,000 to $20,000 yearly. Studying from home lets you save a lot using online programs.

4- Technology and Resources

Online programs may require investments in reliable internet and hardware, though many universities provide free or discounted software.

Comparing Costs: Traditional vs. Online

Traditional Programs: Higher overall cost due to living expenses and campus fees but they also offer networking opportunities.

Online Programs: Lower tuition, no relocation expenses, and flexibility to balance work and study.

With an average Master’s in Accounting salary of $71,000 to $120,000 annually, the investment in your education can pay off quickly, especially with cost-effective online programs.

Accredited Online Masters In Accounting Programs

Pursuing an accredited online Master’s in Accounting degree is a strategic choice for individuals aiming to advance their careers in accounting while enjoying the flexibility of an online format. These programs are designed to provide high-quality education in accounting principles, financial management, taxation, auditing, and more. Accreditation ensures the program meets rigorous academic standards, aligning with industry requirements, and preparing you for key certifications such as CPA, CMA, or CIA.

Why Accreditation is Important

Accreditation plays a crucial role in determining the credibility and quality of your education. Accredited programs are recognized by reputable agencies, ensuring that the curriculum is up-to-date and adheres to the best practices in the field. This helps students develop the skills necessary to succeed in a competitive job market and enhances their professional reputation. Moreover, an accredited Master’s in Accounting program is essential for meeting the eligibility requirements for various certification exams and employment opportunities.

How to Find Accredited Online Programs

When searching for Master’s in accounting online programs, it’s important to look for accreditation from well-respected accrediting agencies. Key agencies include:

- Association to Advance Collegiate Schools of Business (AACSB)

- Accreditation Council for Business Schools and Programs (ACBSP)

- International Assembly for Collegiate Business Education (IACBE)

These agencies assess the quality of the program’s curriculum, faculty, resources, and outcomes. Many universities provide details on their accreditation status on their websites, so be sure to verify this before applying.

Benefits of an Accredited Online Master’s in Accounting

- Quality Education: Accredited programs maintain high educational standards, ensuring that students receive the knowledge and skills required to succeed in accounting careers.

- Flexibility: An online program offers flexibility for working professionals, allowing you to balance work, study, and personal life while still advancing your education.

- Industry Recognition: Graduating from an accredited program boosts your credibility in the job market and may open doors to higher-paying roles in accounting and finance.

- Career Advancement: An accredited Masters in Accounting increases your chances of qualifying for senior positions, including roles such as tax managers, financial analysts, auditors, and controllers.

- Certification Eligibility: Accredited programs prepare you for certification exams like CPA (Certified Public Accountant), CMA (Certified Management Accountant), and others, which can be a significant career booster.

Pursuing an accredited online Master’s in Accounting program offers numerous advantages, including a quality education, career advancement opportunities, and the flexibility to balance your education with your professional life. Always verify the accreditation status before choosing your program to ensure the best investment in your career.

How Long Does A Masters In Accounting Take

Whether you decide to study full-time or part-time, as well as the particular program’s structure, affects the length of a Master’s in Accounting degree.

- Accelerated / Full-Time: 12 to 18 months – intensive, condensed study plan.

- Standard Full-Time: 1.5 to 2 years – balanced coursework with regular academic load.

- Part-Time (for working professionals): Typically 2.5 to 3 years, depending on the number of courses per semester.

- Online (self-paced or flexible): 2 to 3 years common – gives flexibility for work-study balance.

Your time to completion will depend on course load, program format (online or on-site), and whether you study full-time or part-time.

What Can You Do With A Master’s in Accounting

A Master’s in Accounting opens doors to advanced, specialized, and leadership roles across multiple sectors. After graduation and certification, you could pursue:

- Public accounting (audit, tax advisory)

- Corporate accounting and finance (controllers, financial managers)

- Forensic accounting and fraud investigation

- Government and regulatory finance roles

- Internal auditing and compliance roles

- Management accounting and strategic financial planning

- Consulting, advisory, and financial advisory services

- Academia or teaching (with additional qualifications)

The advanced knowledge and credentials make you stand out in competitive hiring pools and prepare you for senior-level positions.

What Can You Do With an Accounting Degree?

Step into roles in finance, audit, or corporate strategy. Turn your passion for numbers into a thriving career!

Masters In Accounting Jobs

Here are common job roles for graduates, with typical salary ranges (based on recent data) and brief role summaries:

| Job Title | Role Summary | Annual Median / Typical Salary |

|---|---|---|

| Accountant / Auditor | Prepares and reviews financial records, ensures compliance, and performs audits | $81,680 (2024 median salary) |

| Internal Auditor | Assesses internal controls, risk management processes, and improves corporate governance | $93,613 (average base salary, 2025) |

| Tax Manager / Tax Consultant | Handles corporate or personal tax planning, compliance, and tax strategy | Ranges between $110,000 – $147,500, 2025. (Higher-end roles vary by firm/experience) |

| Forensic Accountant | Investigates fraud, conducts financial investigations, and supports legal proceedings | Average base salary of $117,400 in 2025. (Salary varies by case load & employer; higher with experience/specialization) |

| Financial Controller / Corporate Finance Manager | Oversees financial operations, reporting, budgeting, and strategic financial planning for companies | $161,700 (2024 median salary) |

| Certified Public Accountant (CPA) | Performs audits, tax filing & advisory, and financial reporting; can work independently or for firms | ~$99,000 in 2024.Earnings vary widely, dependent on clients, specialization, and experience. |

| Consultant / Advisory Roles | Provides expert accounting, compliance, and financial strategy advice to firms or clients | Compensation depends on consultancy fees, clients, and specialization |

*Salaries depend heavily on experience, location, specialization, and whether you hold certifications (CPA, CMA, etc.)

Because of stable job demand and certification eligibility, a master’s degree often leads to supervisory or specialized finance roles, substantially boosting earning potential.

🎓 Your Master’s in Accounting Starts Here

Step into leadership roles, boost your salary potential, and become CPA-ready with an accredited degree.

🚀 Start My Application Today — It takes just 2 minutesFAQ’s

▶ Can You Get A Masters In Accounting Without A Bachelor’s In Accounting?

Yes, many master’s in accounting programs accept students with bachelor’s degrees in related fields (finance, business, economics). However, if your undergraduate background lacks core accounting courses, you may need to complete prerequisite courses in accounting fundamentals before starting the master’s curriculum.

▶ Is A Masters In Accounting Hard?

A master’s in accounting is rigorous. It covers advanced topics in taxation, auditing, financial reporting, and regulatory compliance. If you have a strong foundation in mathematics, accounting, or business, and are ready to commit time and effort, the program is manageable. The return on effort, in terms of job prospects and pay, is often worth it.

▶ How Much Can You Make With A Masters In Accounting?

Median pay for accountants and auditors was $81,680 in May 2024. This suggests that with experience, specialization (like tax, forensic accounting, corporate finance), and certifications (CPA, CMA), salaries can rise significantly, especially in senior, managerial, or consulting roles.

▶ What Are The Benefits Of Getting A Masters In Accounting?

Earning a Master’s degree in Accounting offers several professional and academic advantages including:

- Industry Demand: With steady projected growth and recurring demand for financial expertise, accounting remains a stable and in-demand field.

- Advanced Career Opportunities: Qualify for senior roles, like tax manager, controller, or auditor, often with higher pay.

- Certification Eligibility: Meet educational requirements for CPA, CMA, CIA, and other credentials.

- Broader Skill Set: Gain expertise in auditing, taxation, financial analysis, and compliance, valued across industries.

- Flexibility: Online master’s programs allow working professionals to balance work and study.

▶ Can I Complete A Masters In Accounting Online?

Yes. Many universities offer accredited online master’s in accounting programs, combining quality education with flexibility. Online graduates are generally well-prepared for accounting jobs and certifications as on-campus peers, provided the program is properly accredited and meets certification education requirements.

Explore More Resources

How To Become An Accountant?

Learn how to become an accountant, understand CPA requirements, and discover what do accountants do in their roles. Start your…

Masters of Business Administration (MBA)

Explore the benefits of the Master of Business Administration program. Boost your career, earn an MBA degree, and gain valuable…