Explore the differences between public vs private colleges, including cost, class size, and opportunities, to choose the best option for…

Bachelor’s Degree In Finance

Explore a Bachelor's Degree in Finance, top online finance programs, career paths, skills, and salaries to help you launch a successful career in finance

A bachelor’s degree in finance gives you the fundamentals needed to analyze markets, manage corporate funds, and advise clients on investments. The field is expanding as businesses increase demand for financial expertise. Below, we explain program content, career paths, costs, and current salary outlooks to help you decide if finance is right for you.

Introduction

A Bachelor’s Degree in Finance prepares students to develop quantitative, analytical, and practical skills used across banking, corporate finance, investment management, and financial planning.

Financial careers remain attractive: the median annual wage for financial and investment analysts was $101,910 as of May 2024, reflecting strong pay for common entry roles. At the same time, the broader business and financial occupations category is expected to generate roughly 942,500 openings per year on average through the 2024 – 2034 period.

Different program formats such as traditional, on-campus, accelerated or online bachelor’s degree in finance options, let students match study to their schedules and budgets. Throughout this guide, we will walk you through what you’ll study, admission requirements, program length, technical skills you’ll gain, career outcomes (with current salary data), and tips for choosing the best program for your goals.

What Is A Bachelor Of Science In Finance

A Bachelor of Science in Finance provides students with comprehensive training in financial theory, markets, business finance, and investment strategies. Through courses in financial management, economics, accounting, and market analysis, often combined with practical case studies, students gain proficiency in corporate finance, investment evaluation, risk management, and market research.

Graduates are prepared to pursue careers as financial analysts, corporate finance associates, investment bankers, financial advisors, and more. The degree builds strong quantitative, analytical, and decision-making skills, which are crucial for addressing corporate financial challenges or advising clients.

Affordable Colleges For Bachelor’s Degree In Finance

For many students, affordability matters. Several reputable colleges and universities offer finance degrees, both on-campus and online, with lower tuition costs, especially for in-state or public institutions.

Choosing an affordable finance program lets students acquire essential financial knowledge without significant debt. The table below showcases all affordable colleges based on the most recent data.

| Rank | College/University Name | Location State | Type | Fee (In State) | Fee (Out-of-State) | Grad Rate (%) |

|---|---|---|---|---|---|---|

| 1 | University of Maryland | Maryland | online | $8,136 | $12,336 | 30% |

| 2 | PennState World Campus | Pennsylvania | online | $15,356 | – | 34% |

| 3 | University of North Texas at Dallas | Texas | online & OnCampus | $9,595 | $21,894 | 44% |

| 4 | Southern New Hampshire University | New Hampshire | online | $17,200 | – | 45% |

| 5 | University of Colorado | Colorado | online & OnCampus | $10,383 | $29,391 | 47% |

| 6 | Purdue Global University | Indiana | online & OnCampus | $10,101 | $14,412 | 48% |

| 7 | Kennesaw University | Georgia | online & OnCampus | $5,808 | $17,736 | 48% |

| 8 | Northern State University | South Dakota | oncampus | $8,845 | $11,947 | 52% |

| 9 | Missouri State University | Missouri | Online | $9,502 | $18,770 | 57% |

| 10 | university of north carolina at greensboro | North Carolina | online & OnCampus | $7,661 | $24,012 | 58% |

| 11 | University of Illinois Chicago | Illinois | OnCampus | $14,338 | $29,884 | 60% |

| 12 | University of West Florida | Florida | Online | $6,360 | $19,241 | 62% |

| 13 | Colorado State University | Colorado | Online | $9,000 | – | N/A |

| 14 | Monroe Community College | New York | Online & OnCampus | InState($6,006) | OutState($11,056) | 22% |

| 15 | Texas A&M University San Antonio | Texas | OnCampus | InState($9,654) | OutState($23,255) | 29% |

| 16 | Texas A&M University Corpus Christi | Texas | Online & OnCampus | InState($9,748) | OutState($20,794) | 34% |

| 17 | Louisiana State University | Louisiana | OnCampus | InState($7,050) | OutState($14,650) | 36% |

| 18 | Berkeley College | California | Online & OnCampus | InState($1,258) | OutState($9,898) | 41% |

| 19 | Roosevelt University | Illinois | OnCampus | TuitionFee($21,315) | – | 41% |

| 20 | Avila University Arizona | Missouri | Online & OnCampus | TuitionFee($42,000) | – | 43% |

| 21 | University of Michigan Flint | Michigan | OnCampus | InState($14,704) | OutState($28,320) | 45% |

| 22 | University of Nebraska Omaha | Nebraska | OnCampus | InState($8,718) | OutState($23,206) | 47% |

| 23 | Mercy University | New York | OnCampus | TuitionFee($22,880) | – | 48% |

| 24 | Marshall University | West Virginia | OnCampus | InState($9,162) | OutState($20,342) | 49% |

| 25 | Radford University | Virginia | OnCampus | InState($12,548) | OutState($25,633) | 50% |

| 26 | Wichita State University | Kansas | OnCampus | InState($9,684) | OutState($19,869) | 51% |

| 27 | University of Tennessee at Chattanooga | Tennessee | OnCampus | InState($10,448) | OutState($18,512) | 53% |

| 28 | Youngstown State University | Ohio | OnCampus | InState($11,113) | OutState($11,473) | 53% |

| 29 | Western Kentucky University | Kentucky | OnCampus | InState($11,652) | OutState($27,000) | 54% |

| 30 | Arkansas State University | Arkansas | OnCampus | InState($8,090) | OutState($14,522) | 55% |

| 31 | Texas State University | Texas | OnCampus | InState($11,450) | OutState($22,930) | 56% |

| 32 | Southern Utah University | Utah | Online & OnCampus | InState($6,962) | OutState($21,192) | 59% |

| 33 | University of Illinois at Springfield | Illinois | OnCampus | InState($12,252) | OutState($22,017) | 61% |

| 34 | University of Alabama Birmingham | Alabama | Online | InState($9,098) | OutState($22,562) | 63% |

| 35 | University of Wisconsin Whitewater | Wisconsin | Online & OnCampus | InState($8,616) | OutState($18,716) | 64% |

| 36 | Arizona State University | District of Columbia | OnCampus | NA | NA | NA |

Best colleges for Bachelor’s degree in finance

Top finance colleges typically offer strong faculty, robust finance and economics departments, internship opportunities with financial firms, and high placement rates. These institutions often also provide specializations, for example in corporate finance, investment banking, or financial management by helping students align their education with career ambitions.

| Rank | College/University Name | Location State | Type | Fee (In State) | Fee (Out-of-State) | Grad Rate (%) |

|---|---|---|---|---|---|---|

| 1 | North Eastern University | Massachusetts | Online&OnCampus | $66,162 | – | 90% |

| 2 | University of Connecticut | Connecticut | OnCampus | $21,044 | $43,712 | 84% |

| 3 | UMASS Amherst | Massachusetts | Online | $17,772 | $40,449 | 83% |

| 4 | University Of Dayton | Ohio | OnCampus | $49,140 | – | 82% |

| 5 | Miami University | Ohio | OnCampus | $18,161 | $41,221 | 82% |

| 6 | James Madison University(UG) | Virginia | OnCampus | $14,250 | $31,604 | 81% |

| 7 | Marist College | New York | OnCampus | $47,750 | – | 80% |

| 8 | Saint Louis University | Missouri | OnCampus | $55,760 | – | 80% |

| 9 | Devry University | Arizona | Online | $17,408 | – | 80% |

| 10 | American University | District of Columbia | OnCampus | $58,771 | – | 78% |

| 11 | University of Denver | Colorado | OnCampus | $61,398 | – | 78% |

| 12 | Webster University | Missouri | Online&OnCampus | $31,750 | – | 77% |

| 13 | University of New hampshire | New Hampshire | OnCampus | $19,202 | $39,852 | 76% |

| 14 | University of Oklahoma | Oklahoma | Online&OnCampus | $9,797 | $27,377 | 75% |

| 15 | Florida International University | Florida | Online&OnCampus | $6,565 | $18,964 | 74% |

| 16 | Sacred Heart University | Connecticut | OnCampus | $50,404 | – | 74% |

| 17 | New Jersey Institute of Technology | New Jersey | OnCampus | $19,974 | $37,664 | 73% |

| 18 | Mercer University Atlanta & Macon | Georgia | OnCampus | $42,312 | – | 73% |

| 19 | Fairleigh Dickinson University | New Jersey | OnCampus | $38,004 | – | 72% |

| 20 | University of Cincinnati | Ohio | OnCampus | $13,976 | $29,310 | 72% |

| 21 | Oregon State University | Oregon | Online | $14,400 | $38,190 | 71% |

| 22 | Rochester Institute of Technology | New York | OnCampus | $59,274 | – | 71% |

| 23 | Anderson University | South Carolina | OnCampus | $34,970 | – | 71% |

| 24 | Simmons University | Massachusetts | OnCampus | $46,874 | – | 71% |

| 25 | DePaul University | Illinois | OnCampus | $45,999 | – | 70% |

| 26 | Grand Valley State University | Michigan | OnCampus | $15,140 | $21,548 | 69% |

| 27 | Adelphi University | New York | OnCampus | $49,110 | – | 69% |

| 28 | The University of Kansas | Kansas | OnCampus | $12,102 | $30,432 | 69% |

| 29 | Trine University | Indiana | OnCampus | $36,560 | – | 68% |

| 30 | Thomas Jefferson University | Pennsylvania | OnCampus | $47,505 | – | 68% |

| 31 | University of The Pacific | California | OnCampus | $57,080 | – | 68% |

| 32 | Hofstra University | New York | OnCampus | $57,660 | – | 67% |

| 33 | Lawrence Technological University | Michigan | Online&OnCampus | $44,760 | – | 63% |

| 34 | Pace University | New York | OnCampus | $53,290 | – | 61% |

| 35 | Suffolk University Boston/Madrid | Massachusetts | OnCampus | $47,550 | – | 60% |

| 36 | University Of New Haven | Connecticut | OnCampus | $47,332 | – | 59% |

| 37 | University of Hartford | Connecticut | OnCampus | $49,075 | – | 58% |

| 38 | Alvernia University | Pennsylvania | OnCampus | $45,000 | – | 58% |

| 39 | LIU Brooklyn /Post | New York | OnCampus | $42,432 | – | 55% |

| 40 | Middle Tennessee State University | Tennessee | OnCampus | $10,266 | $31,574 | 54% |

| 41 | Umass Boston | Massachusetts | OnCampus | $15,908 | $38,125 | 51% |

| 42 | University Of Bridgeport | Connecticut | OnCampus | $35,760 | – | 48% |

When choosing a college, look for accreditation, curriculum strength, industry connections, and alumni success to ensure students receive both a quality education and good career prospects.

What Are The Admission Requirements For a Bachelor’s Degree in Finance?

Usually, students have to meet these criteria to be admitted into a Bachelor’s Degree in Finance program:

1. Educational Background

- A high school diploma or equivalent (e.g., GED) is mandatory.

- A strong academic record, especially in mathematics, economics, and business-related courses, is often preferred.

2. GPA Requirements

- Most universities require a minimum cumulative GPA of 2.5-3.0 on a 4.0 scale.

- Competitive programs, especially in top business schools, may expect GPAs above 3.5.

3. Standardized Test Scores

- ● SAT or ACT scores may be required, depending on the institution.

- ◉ SAT: A combined score of 1000 -1200+ is typically competitive.

- ◉ ACT: Scores of 20 – 26+ are generally acceptable.

- ● Some colleges are now test-optional, especially after COVID-19.

4. Prerequisite Courses

- Completion of high school courses in:

- Algebra, geometry, and pre-calculus or calculus

- English (4 years)

- Social studies/economics

- Science (usually 2–3 years)

5. Application Materials

- Completed application form (via Common App, Coalition App, or university portal)

- Official transcripts from high school

- Letters of recommendation (usually 1–2)

- Personal statement or essay explaining the applicant’s interest in finance

- Application fee (typically $30–$75)

6. Optional but Recommended

- Resume/CV with extracurriculars, work experience, and volunteer activities

- Interview (some schools conduct optional or required interviews)

Get Started – No Application Fee

Apply now and take the first step toward your finance career.

Technical Skills Gained After Completing Bachelor’s Degree In Finance

A finance degree equips students with a range of technical and analytical skills that are highly valued in the finance industry:

Financial Analysis:

Assess financial statements, study trends, and support data-driven decisions.

Data Analysis & Modeling:

Use statistical tools and financial modeling techniques to forecast and evaluate investments.

Accounting & Financial Reporting:

Understand accounting rules and maintain accurate financial records.

Risk Management:

Identify financial risks and develop strategies to mitigate them.

Investment Analysis:

Evaluate assets, investment opportunities, and portfolio performance.

Quantitative Methods:

Apply mathematics and statistics for forecasting, valuations, and financial planning.

Regulatory & Compliance Knowledge:

Understand financial regulations, laws, and ethical standards.

Project Management:

Plan, execute, and manage finance-related projects and operations.

Communication & Reporting:

Present complex financial data clearly to stakeholders.

Use of Financial Software & Tools:

Gain proficiency in spreadsheets, financial software, and data-analysis applications.

These skills give graduates flexibility across roles – from banking and investment firms to corporate finance teams and consulting.

How Long Does It Take To Get A Bachelor’s Degree In Finance

Earning a Bachelor’s degree in Finance typically requires four years of full-time study. The program includes coursework in economics, accounting, and financial management, providing students with a strong foundation for careers in finance and business.

| Degree Format | Typical Course Duration |

|---|---|

| Campus-Based | 4 years (full-time) |

| 4-6 years (part-time) | |

| Online | 3-4 years (accelerated programs) |

| 4 years (standard programs) |

Your choice depends on your schedule, lifestyle, and whether you prefer flexibility or in-person learning.

What Is The Difference Between Online Finance Degree And On-Campus Finance Degree

Choosing between an on-campus and an online bachelor’s degree in finance depends on key differences like cost, learning style, duration, and flexibility. Each option has its own benefits, based on your lifestyle and how you prefer to study.

| Criteria | Online Finance Degree | On-Campus Finance Degree |

|---|---|---|

| Duration | Time period 3-4 years (accelerated options available) | Time period 4 years (full-time) |

| Flexibility | High flexibility; study at your own pace and schedule | Fixed schedule; classes at set times |

| Fees | Often lower tuition and costs (e.g., no commuting) | Generally, higher tuition and additional costs (e.g., housing) |

| Learning Environment | Online platforms, self-paced learning, and virtual interaction | In-person classes, hands-on experience, and face-to-face interaction |

| Access to Resources | Limited campus resources; reliance on online tools | Full access to campus facilities, libraries, and support services |

| Networking Opportunities | Online networking through virtual events and forums | Direct networking with peers, professors, and industry professionals |

| Class Size | Class size is larger due to the scalability of online platforms | Typically smaller, allowing for more personalized attention |

| Assessment Methods | Primarily online exams and projects | Combination of in-person exams, projects, and presentations |

Drive Growth. Lead Investments. Build Empires.

Let your Finance Degree open doors worldwide!

Learn MoreFinance Bachelor Degree Jobs

A Bachelor of Finance degree opens up a lot of fulfilling employment paths. Ustilising their abilities to create company growth and properly manage financial assets, graduates may seek positions in financial analysis, investment banking, and financial planning. Here are some common finance jobs for graduates, with brief descriptions and salary:

| Job Title | Description | ANNUAL MEDIAN SALARY (2025) |

|---|---|---|

| Financial Analyst | Analyzes financial data, prepares reports, and helps businesses make informed investment decisions. | $101,910 |

| Accountant | Prepares and examines financial records, ensuring accuracy and compliance with regulations. | $75,000 |

| Investment Banker | Assists companies in raising capital through securities, mergers, and acquisitions, requiring strong analytical skills. | $54,278 |

| Financial Planner | Helps clients manage their finances by providing guidance on investments, savings, and retirement planning. | $95,590 |

| Portfolio Manager | Manages investment portfolios for clients, analyzing market trends and making investment decisions to achieve financial goals. | $114,820 |

| Risk Analyst | Assesses financial risks for an organization and develops strategies to mitigate those risks, often using statistical models. | $92,200 |

| Credit Analyst | Evaluates the creditworthiness of individuals or businesses, analyzing financial statements and credit data to determine lending risks. | $58,103 |

| Commercial Banker | Works with businesses to provide financial services, including loans, credit lines, and treasury management solutions. | $54,421 |

*Salary ranges vary widely based on location, experience, industry, bonuses, and additional qualifications.

🎓 Craft a Winning College Resume

Applying for a Bachelor’s in Finance? Make your application stand out.

Read: How to Create a High School Resume →Is A Bachelor’s Degree In Finance Worth It?

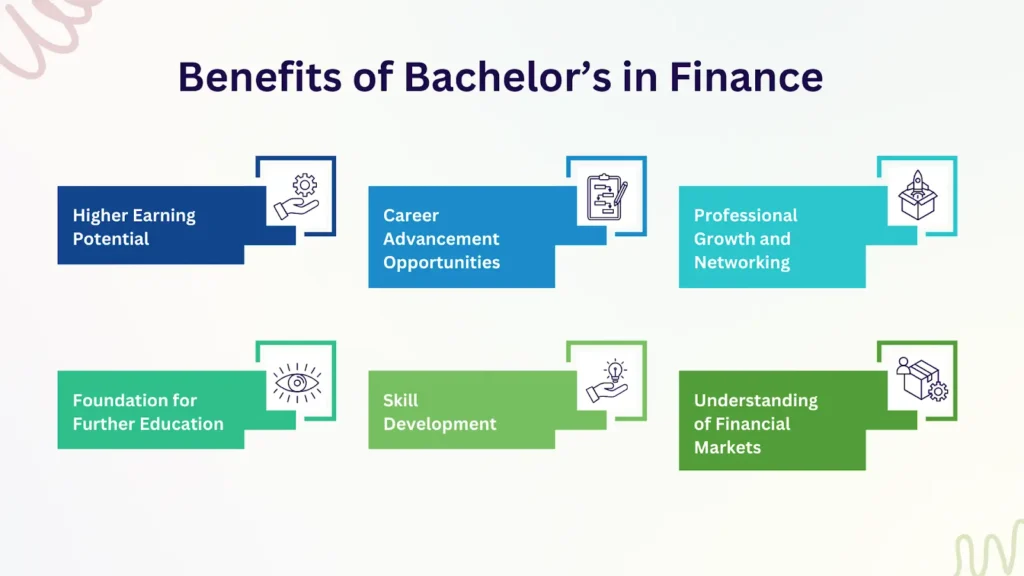

In today’s competitive job market, the value of a Bachelor’s degree in Finance is a topic of considerable debate. Explore the benefits of pursuing a finance degree, examining its potential return on investment, career opportunities, and the skills acquired during the program.

1- Higher Earning Potential

Compared to people without a degree, a Bachelor’s degree in finance raises earning potential. Usually qualified for better-paying entry-level finance bachelor’s degree jobs, graduates have the chance to make even more as they grow in their professions and gain experience. With time, this financial advantage might result in a substantial return on investment.

2- Career Advancement Opportunities

Students with a bachelor’s degree in finance have higher chances of getting promoted and may choose from a larger employment options. This degree will help you grow in your career to management and leadership positions and serve as a basis for many finance-related employment opportunities.

★ Corporate Finance Manager

★ Financial Analyst

★ Investment Banker

★ Financial Planner

★ Risk Manager

3- Professional Growth and Networking

Getting a degree in finance can help you network through jobs, contacts with students, and relationships with businesses. These links can help you get jobs and find a guide, which can enhance your professional growth and work opportunities.

4- Foundation for Further Education

A bachelor’s degree in finance can help you get higher degrees like an MBA or specialty certifications like the Chartered Financial Analyst (CFA). There are more job possibilities, higher earnings potential, and a competitive edge in the job market for people with these qualifications.

5- Skill Development

Students learn important skills such as analyzing finances, understanding data, handling risks, and making future plans through this program. Many different types of businesses seek graduates with these skills, which makes them flexible and able to take on various tasks.

6- Understanding of Financial Markets

A degree in finance provides graduates with a thorough awareness of financial markets and institutions, therefore helping them to negotiate the complexity of the economic terrain. Making wise judgments in both personal and business financial concerns depends much on this understanding.

All things considered, a Bachelor’s degree in Finance provides several long-term advantages that support both personal and professional development in the exciting field of finance, in addition to increasing earning potential.

Already Have a Bachelor’s in Finance? What’s Next?

Take your career to the next level with a Master’s degree in Finance or an MBA.

FAQ’s

▶ How Much Does an Online Bachelor’s in Finance Cost?

Online Bachelor of Science in Finance degree programs usually cost between $30,000 and $70,000 for the whole study. Institutional renown, program time, and whether it’s public or private are some of the things that affect fees. For example, textbooks, training materials, and internet fees may incur additional costs. The total cost of obtaining a degree can be lowered by using financial aid, grants, and payment plans that many schools offer.

▶ What are the different degrees in finance?

- Bachelor’s Degree in Finance: Foundational knowledge in financial principles.

- Master’s Degree in Finance (MSF): Advanced study of specialized finance topics.

- MBA with Finance Concentration: Combines business and finance education for leadership roles.

- Doctorate in Finance (Ph.D.): Research-focused degree for academic and advanced finance careers.

▶ What to Consider Before Choosing a Finance Program

When picking a financial school, some of the important factors include: accreditation, course quality, faculty expertise, internship or placement support, tuition cost, flexibility (online vs campus), and post-graduation job outcomes.

▶ Can you get a CPA with a finance degree?

You can become a CPA with a finance degree, but the degree alone is usually not enough. Most states require 150 semester credit hours that include specific accounting coursework – such as auditing, taxation, and financial accounting, which many finance programs do not fully cover. This means you may need to take additional accounting classes or pursue a post-baccalaureate certificate to meet eligibility requirements. Always review your state’s CPA requirements, as they vary, and remember you must also pass the CPA Exam to earn the credential.

▶ What is the difference between accounting and finance?

◈ Accounting: Focuses on recording, reporting, and auditing financial transactions and historical data.

◈ Finance: Concerned with using financial data to make forward-looking decisions — investments, budgeting, financial planning, risk analysis, and strategic business finance.

Both are essential to a firm; accounting ensures accuracy and compliance; finance drives growth, investments, and strategy.

Explore More Resources

College Vs University

Understanding the difference between college and university and exploring college vs. university factors to help you choose the best education…

Externship Vs. Internship: Key Differences You Must Know

IntroductionThe key difference between an externship and an internship lies in their structure, duration, and learning experience. While both provide…